Table of Content

When considering a refinance, it’s also a good idea to exploredifferent kinds of loans and loan termsto determine what’s best for you and your budget. Refinancing into a conventional fixed-rate loan from anFHA loancould mean significant savings since these government-insured loans usually have costly insurance premiums. While a 20-year mortgage means you'll pay off your loan faster than a 30-year mortgage, it also means you'll have higher monthly payments. However, the lower monthly payments that come with a 30-year mortgage means you can borrow a larger amount. Having a healthier credit score and better loan-to-value ratios will generally get a larger reduction on their refinance interest rate. You can also use a mortgage calculator with taxes, insurance, and HOA dues included to estimate your total mortgage payment and home buying budget.

While we adhere to strict editorial integrity, this post may contain references to products from our partners. Stability – You’ll be able to lock in the interest rate on your mortgage for the entire 20-year term. This gives you a degree of predictability you won’t have with an adjustable-rate mortgage . So we give you the opportunity to compare deals offered by the banks and choose the one with the most favourable interest rates.

Home loan interest rates: What your bond will cost in 2022

You can use the extra funds as cash to make home improvements or consolidate debt. Fixed-rate mortages get their name because the rate of interest charged throughout the duration of the loan is static or fixed. This means the rate of interest & monthly payment toward principal and interest will not change throughout the duration of the loan. The most popular FRM is the 30-year loan as it enables consumers to lock in a low rate of interest for an extended period of time & have low monthly payments.

Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Across the United States 88% of home buyers finance their purchases with a mortgage. Of those people who finance a purchase, nearly 90% of them opt for a 30-year fixed rate loan.

Cons of a 20-year fixed-rate mortgage

If you plan to use a gift for your down payment, you’ll need to provide a detailed paper trail showing where the money came from. The interest rate on a home loan will vary depending on what the bank is willing to offer, and how much of a risk they consider you to be. The central bank is expected to raise rates by 75 basis points for a fourth straight time at the conclusion of its next policy meeting on Nov. 1-2. You'll be paying more in interest fees on a 20-year mortgage than if you had a 10- or 15-year mortgage, which means it'll be more expensive. With high inflation lingering longer than initially expected the Federal Reserve has raised interest rates three times.

Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. The home is typically the largest purchase most consumers will ever make in their lifetimes. While the 30-year loan is more popular, the 20-year builds equity faster & charges a lower rate of interest which saves even more money. The above table shows how a person choosing the 20-year option can save nearly $90,000 in interest by paying about $260 more per month than they would pay on a 30-year loan. Some buyers who choose a 30-year loan may believe they'll make plenty of extra payments along the way to pay off their home faster, but money sitting around often finds a way to be spent.

Comparing 20-year Mortgages to Other Loan Terms

Adjustable-rate mortgages get their name because the rate of interest is variable and can change as economic conditions change. Most ARM loans are hybrid loans which have an introductory period that acts similarly to a FRM in the initial portion of the loan. Typically the initial & subsequent single adjustment limit is set to 1% or 2% while the lifetime rate cap is usually set to 5% or 6% above the rate initially charged on the loan. The cost of obtaining a mortgage varies due to differences in financial institutions, unique regions such as states in the U.S., the amount of the loan and several other factors. The borrower’s credit history will often have a significant impact on the cost of the loan and the interest rate being offered.

If you’re considering a 20-year fixed over a 30-year fixed mortgage, keep in mind that the 20-year mortgage has a higher monthly payment. For example, on a 30-year fixed rate mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payments would be about $1,111 . But a 20-year fixed rate mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.00%, the monthly payments would be about $1,331 . Even with a lower rate, the monthly payments can be higher for a 20-year fixed mortgage than a 30-year fixed mortgage. The higher monthly mortgage payment may not meet your budget or affordability. Since the rates on ARMs are usually initially lower than fixed-rate loans and if you’re planning to sell your home in a few years, it may make sense to go with an ARM vs. a fixed-rate loan.

How to Find the Best 20-year Mortgage

Because your credit history is so vital to your score, experts recommend checking your credit report to check for any discrepancies or what could be affecting your score before applying for a loan. A good mortgage rate is relative and will depend on your credit profile. For instance, if you make a large down payment, your rate will most likely be lower than someone who puts a lower down payment . Or if you have a lower credit score, the chances of you receiving a very competitive rate will be slim.

Your monthly payments will be higher than they would be with a 30-year loan, meaning that you may experience a squeeze if you experience a job loss or decrease in income. On the other hand, if you’re struggling to afford your monthly payment, a 20-year loan might pose a challenge. That’s because a 20-year loan’s monthly payments will be higher than a 30-year loan for the same amount. Information provided on Forbes Advisor is for educational purposes only.

Refinancing to a 15-year fixed-rate mortgage will cost less interest over the life of the loan than a 20-year mortgage of the same loan amount. If higher payments are manageable and paying off your loan faster and for less interest are priorities for you, then a 15-year mortgage may make sense for your situation. To get the best rate on a 20-year fixed rate loan, you should shop around for rates, keep track of mortgage rate trends, and talk to multiple lenders. You can compare multiple quotes from lenders on Zillow, anonymously.

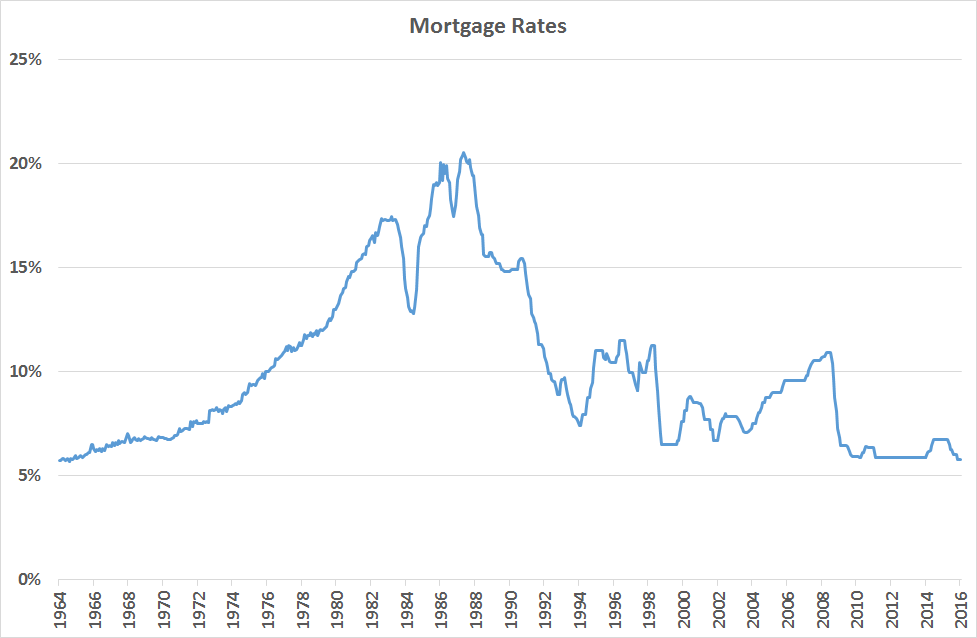

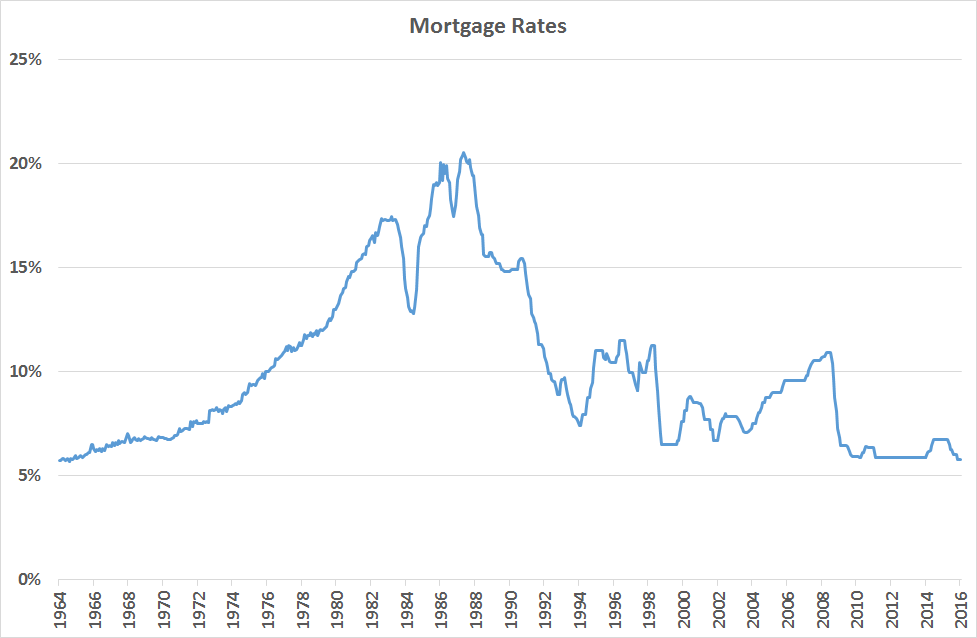

The quicker you reach your break even, typically, the more cost-effective the refinance becomes. Fifteen-year fixed mortgage rates are typically lower, which means you pay less interest over the life of the loan. However, the shorter repayment schedule increases your principal and interest payments — which could put a squeeze on your budget if your income or expenses suddenly change. 1971 was the first year Freddie Mac started surveying mortgage lenders, and 30-year fixed-rate mortgages hovered between 7.29% and 7.73%. The annual rate of inflation started spiking in 1974 and continued to spike into the 1980s.

On Friday, December 23, 2022, the national average 20-year fixed mortgage APR is 6.19%. The average 20-year refinance APR is 6.54%, according to Bankrate's latest survey of the nation's largest refinance lenders. Andrea Riquier is a New York-based writer covering mortgages and the housing market for Forbes Advisor. She was previously at Dow Jones MarketWatch, on the housing market and financial markets beats. Before that, she covered macro and central banks for Investor's Business Daily, and municipal bonds for Debtwire.

No comments:

Post a Comment